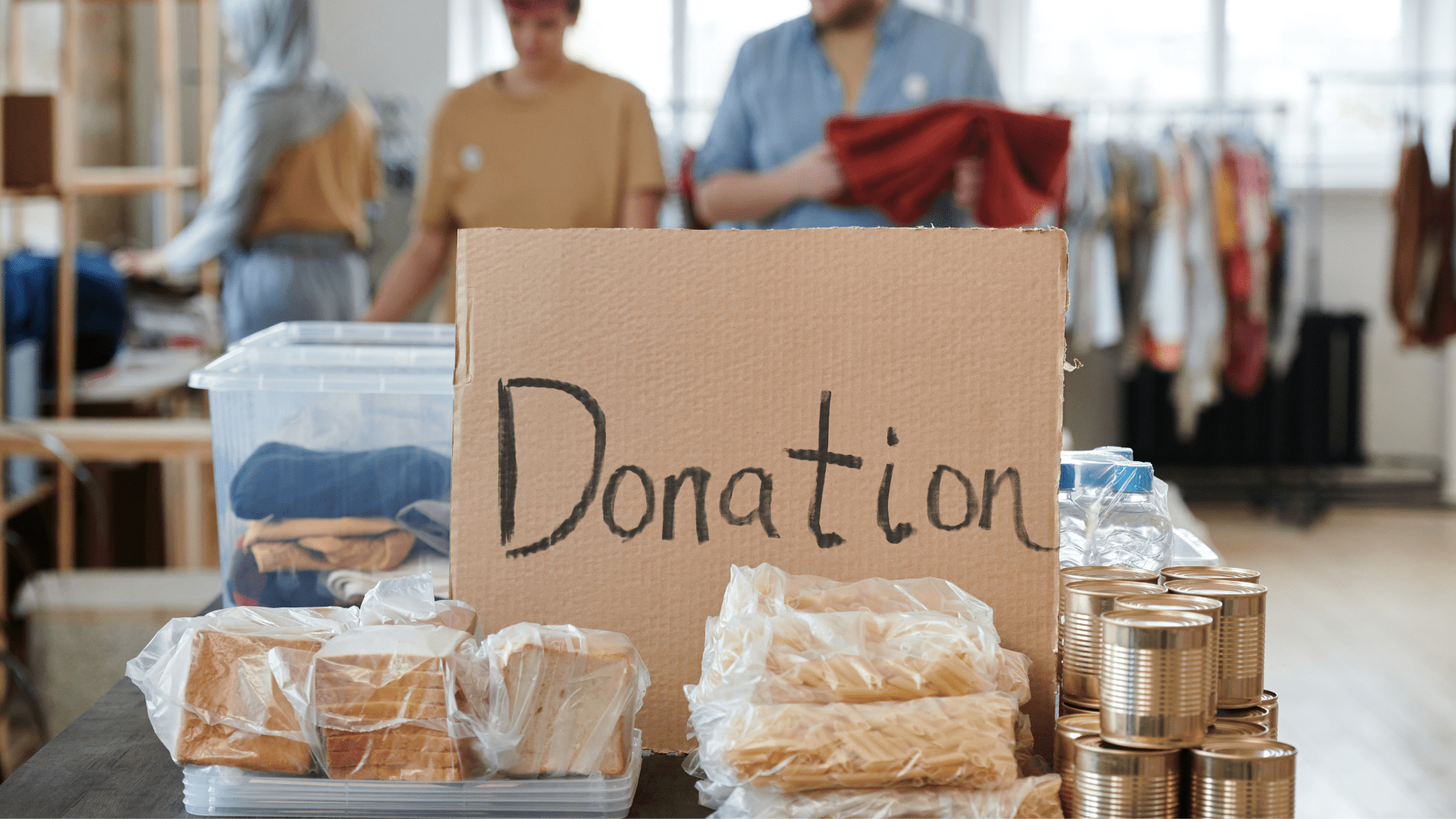

Support Student Success

with a Donation

Gifts to the Mary Lyon Foundation are completely customizable. You may make a one-time gift or pledge over 3-5 years. Some choose to make a gift every year. Individuals who include the Foundation in their estate plans will be welcomed into the Putnam Hill Legacy Society.

All donations can be allocated to your fund of choice:

- General Support: Supporting the Foundation wherever it is needed the most.

- Student Assistance Fund: Providing eyeglasses, groceries, clothes, shoes, and prescriptions.

- Literacy Program: Providing books to promote literacy.

- Educator Assistance Program: Supporting innovative teaching practices & professional development.

- Emergency Fund: Providing support for students & families who find themselves in difficult circumstances.

Minimum Qualified Distribution: The qualified charitable distribution (QCD) rule allows traditional individual retirement account (IRA) owners to deduct their required minimum distributions (RMDs) on their tax returns if they give the money to a charity. The rule can effectively reduce your income taxes by lowering your adjusted gross income (AGI).

Are you able to do more?

Volunteer with us

Our volunteers are at the heart of our programming. They are the lifelines of our programming. Without them, we would be unable to make a difference in our community's children, families, and educators. Because of the commitment of our volunteers, we deliver groceries to 130 people every other Tuesday.

Are you interested in making a difference in our community? Do you have a particular skill to offer?

Some of the ways in which you can volunteer at the Mary Lyon Foundation:

- Assist with our food delivery program

- Write grants for the Foundation

- Assist with event planning

- Serve on our Fundraising Committee

- Serve on our Board of Trustees

- Serve on our Finance Committee

- Help in the office

To talk about volunteer opportunities, please complete the form below or email us at [email protected].